Multiple Choice

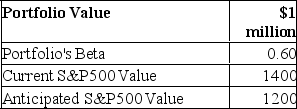

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  What is the dollar value of your expected loss?

What is the dollar value of your expected loss?

A) $142,900

B) $16,670

C) $85,700

D) $30,000

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Which one of the following stock index

Q6: Hedging one commodity by using a futures

Q7: Covered interest arbitrage<br>A)ensures that currency futures prices

Q8: If interest rate parity does not hold,<br>A)covered

Q10: Which one of the following stock index

Q11: Suppose that the risk-free rates in the

Q12: Suppose that the risk-free rates in the

Q13: You are given the following information about

Q13: A swap<br>A) obligates two counterparties to exchange

Q54: Which one of the following stock index