Multiple Choice

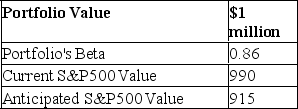

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  What is the dollar value of your expected loss?

What is the dollar value of your expected loss?

A) $142,900

B) $65,200

C) $85,700

D) $30,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: If interest rate parity does not hold,<br>A)covered

Q9: You are given the following information about

Q10: Which one of the following stock index

Q11: Suppose that the risk-free rates in the

Q12: Suppose that the risk-free rates in the

Q13: A swap<br>A) obligates two counterparties to exchange

Q15: You are given the following information about

Q16: If you purchased one S&P 500 Index

Q18: Which one of the following stock index

Q38: One reason swaps are desirable is that<br>A)