Multiple Choice

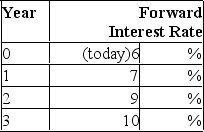

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the yield to maturity of a 3-year zero-coupon bond?

What is the yield to maturity of a 3-year zero-coupon bond?

A) 7.03%

B) 9.00%

C) 6.99%

D) 7.49%

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Given the yield on a 3-year zero-coupon

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the

Q10: Suppose that all investors expect that interest

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Given the bond

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the

Q15: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What is the

Q16: The yield curve is a component of<br>A)the

Q17: If the value of a Treasury bond

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What is the

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the