Multiple Choice

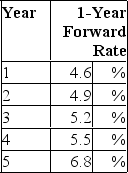

What should the purchase price of a 5-year zero-coupon bond be if it is purchased today and has face value of $1,000?

What should the purchase price of a 5-year zero-coupon bond be if it is purchased today and has face value of $1,000?

A) $776.14

B) $721.15

C) $779.54

D) $756.02

Correct Answer:

Verified

Correct Answer:

Verified

Q4: An upward-sloping yield curve<br>A)may be an indication

Q5: Given the yield on a 3-year zero-coupon

Q6: Structure of interest rates is<br>A)the relationship between

Q7: The following is a list of prices

Q7: Given the yield on a 3-year zero-coupon

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What would the

Q10: Suppose that all investors expect that interest

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Given the bond

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the

Q14: Suppose that all investors expect that interest