Multiple Choice

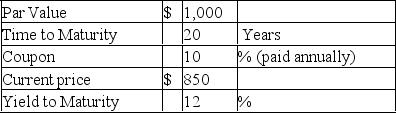

Given the bond described above, if interest were paid semi-annually (rather than annually) , and the bond continued to be priced at $850, the resulting effective annual yield to maturity would be

Given the bond described above, if interest were paid semi-annually (rather than annually) , and the bond continued to be priced at $850, the resulting effective annual yield to maturity would be

A) less than 12%.

B) more than 12%.

C) 12%.

D) Cannot be determined.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Which of the following are possible explanations

Q44: The on the run yield curve is<br>A)

Q48: The most recently issued Treasury securities are

Q50: According to the expectations hypothesis, an upward-sloping

Q51: The yield curve<br>A)is a graphical depiction of

Q52: When computing yield to maturity, the implicit

Q53: Suppose that all investors expect that interest

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Calculate the price

Q55: If the value of a Treasury bond

Q56: If the value of a Treasury bond