Multiple Choice

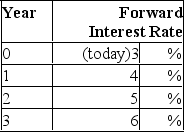

Suppose that all investors expect that interest rates for the 4 years will be as follows:  If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000.)

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000.)

A) 5%

B) 3%

C) 9%

D) 10%

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Which of the following are possible explanations

Q44: The on the run yield curve is<br>A)

Q48: The most recently issued Treasury securities are

Q50: According to the expectations hypothesis, an upward-sloping

Q51: The yield curve<br>A)is a graphical depiction of

Q52: When computing yield to maturity, the implicit

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Calculate the price

Q55: If the value of a Treasury bond

Q56: If the value of a Treasury bond

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Given the bond