Multiple Choice

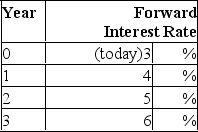

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the yield to maturity of a 3-year zero-coupon bond?

What is the yield to maturity of a 3-year zero-coupon bond?

A) 7.00%

B) 9.00%

C) 6.99%

D) 4.00%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: Treasury STRIPS are<br>A) securities issued by the

Q25: Investors can use publicly available financial data

Q26: Forward rates _ future short rates because

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What is the

Q29: The following is a list of prices

Q30: An upward sloping yield curve is a(n)

Q31: The expectations theory of the term structure

Q32: Suppose that all investors expect that interest

Q33: The following is a list of prices

Q56: Bond stripping and bond reconstitution offer opportunities