Multiple Choice

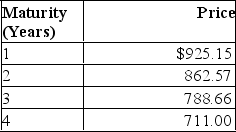

The following is a list of prices for zero-coupon bonds with different maturities and par values of $1,000.  You have purchased a 4-year maturity bond with a 9% coupon rate paid annually.The bond has a par value of $1,000.What would the price of the bond be one year from now if the implied forward rates stay the same?

You have purchased a 4-year maturity bond with a 9% coupon rate paid annually.The bond has a par value of $1,000.What would the price of the bond be one year from now if the implied forward rates stay the same?

A) $995.63

B) $1,108.88

C) $1,000.00

D) $1,042.78

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Treasury STRIPS are<br>A) securities issued by the

Q25: Investors can use publicly available financial data

Q26: Forward rates _ future short rates because

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What is the

Q28: Suppose that all investors expect that interest

Q30: An upward sloping yield curve is a(n)

Q31: The expectations theory of the term structure

Q32: Suppose that all investors expect that interest

Q33: The following is a list of prices

Q34: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What would the