Multiple Choice

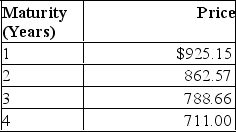

The following is a list of prices for zero-coupon bonds with different maturities and par values of $1,000.  According to the expectations theory, what is the expected forward rate in the third year?

According to the expectations theory, what is the expected forward rate in the third year?

A) 7.23%

B) 9.37%

C) 9.00%

D) 10.9%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Calculate the price

Q3: Suppose that all investors expect that interest

Q4: An upward-sloping yield curve<br>A)may be an indication

Q5: Given the yield on a 3-year zero-coupon

Q6: Structure of interest rates is<br>A)the relationship between

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What would the

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the

Q10: Suppose that all investors expect that interest

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" Given the bond

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the