Multiple Choice

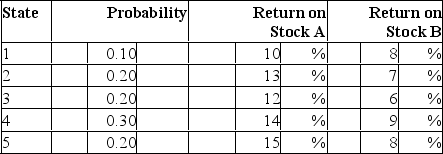

Consider the following probability distribution for stocks A and B:  If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation?

If you invest 40% of your money in A and 60% in B, what would be your portfolio's expected rate of return and standard deviation?

A) 9.9%; 3%

B) 9.9%; 1.1%

C) 11%; 1.1%

D) 11%; 3%

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Given an optimal risky portfolio with expected

Q18: For a two-stock portfolio, what would be

Q20: Consider the following probability distribution for stocks

Q21: Consider the following probability distribution for stocks

Q23: As the number of securities in a

Q24: Security X has expected return of 7%

Q25: Consider the following probability distribution for stocks

Q26: Which of the following statement(s) is(are) false

Q27: The standard deviation of a portfolio of

Q68: Market risk is also referred to as<br>A)