Multiple Choice

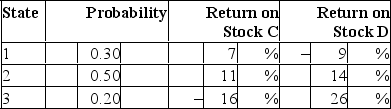

Consider the following probability distribution for stocks C and D:  If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation?

If you invest 25% of your money in C and 75% in D, what would be your portfolio's expected rate of return and standard deviation?

A) 9.891%; 8.70%

B) 9.945%; 11.12%

C) 8.225%; 8.70%

D) 10.275%; 11.12%

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Given an optimal risky portfolio with expected

Q18: For a two-stock portfolio, what would be

Q20: Consider the following probability distribution for stocks

Q22: Consider the following probability distribution for stocks

Q23: As the number of securities in a

Q24: Security X has expected return of 7%

Q25: Consider the following probability distribution for stocks

Q26: Which of the following statement(s) is(are) false

Q27: The standard deviation of a portfolio of

Q50: The unsystematic risk of a specific security<br>A)