Multiple Choice

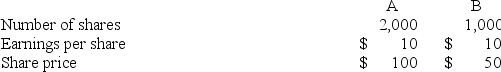

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2,500 shares of A outstanding) . Suppose that the merger really does increase the value of the combined firms by $20,000. . What is the cost of the merger?

A) zero

B) $2,000

C) $8,000

D) $4,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Firm A has a value of $200

Q8: The gain from a merger is computed

Q9: The following data on a merger are

Q10: As a pre-offer defensive maneuver, existing bondholders

Q11: What role do hedge funds take when

Q13: A poison pill defense may be implemented

Q14: Historically, merger activity increases with which market

Q15: Which of the following factor(s)influence(s)the acquiring firm's

Q16: When a merger of two firms is

Q17: Briefly describe some of the good motives