Multiple Choice

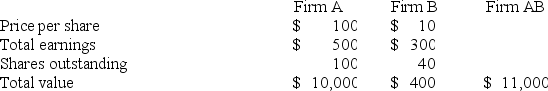

The following data on a merger are given:

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the postmerger P/E ratio, assuming that cash is used in the acquisition and the merger has no immediate effect on total firm income.

A) 12.75

B) 6.25

C) 13.75

D) 17.85

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Suppose that the market price of Company

Q5: A dissident group solicits votes in an

Q6: The following are sensible motives for mergers

Q7: Firm A has a value of $200

Q8: The gain from a merger is computed

Q10: As a pre-offer defensive maneuver, existing bondholders

Q11: What role do hedge funds take when

Q12: Companies A and B are valued as

Q13: A poison pill defense may be implemented

Q14: Historically, merger activity increases with which market