Multiple Choice

Use the information for the question(s) below.

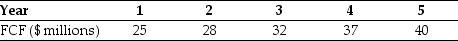

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-If CCM has $150 million of debt and 12 million shares of stock outstanding,then the share price for CCM is closest to:

A) $49.50.

B) $11.25.

C) $20.50.

D) $22.75.

Correct Answer:

Verified

Correct Answer:

Verified

Q86: Which of the following statements is FALSE?<br>A)Many

Q87: Use the information for the question(s)below.<br>Defenestration Industries

Q88: Use the following information to answer the

Q89: Which of the following formulas is INCORRECT?<br>A)Forward

Q90: Which of the following statements is FALSE?<br>A)Stock

Q91: Which of the following statements is FALSE?<br>A)The

Q92: Which of the following formulas is INCORRECT?<br>A)P0

Q93: Which of the following is NOT a

Q94: Monsters Inc.is a utility company that recently

Q95: You expect KT Industries (KTI)will have earnings