Multiple Choice

Use the information for the question(s) below.

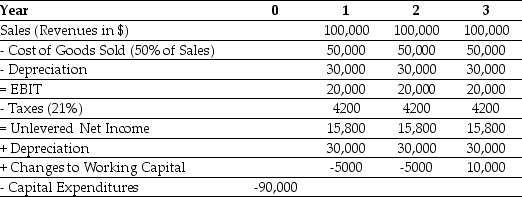

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

A) 11.09

B) 19.14%

C) 12.0%

D) 0%

Correct Answer:

Verified

Correct Answer:

Verified

Q85: How does scenario analysis differ from sensitivity

Q86: Use the information for the question(s)below.<br>Temporary Housing

Q87: Luther Industries has outstanding tax loss carryforwards

Q88: You are considering adding a microbrewery on

Q89: Use the information for the question(s)below.<br>The Sisyphean

Q90: Use the information for the question(s)below.<br>Epiphany Industries

Q91: Use the information for the question(s)below.<br>The Sisyphean

Q92: An exploration of the effect on NPV

Q93: Use the following information to answer the

Q94: Use the following information to answer the