Multiple Choice

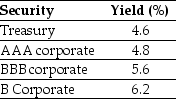

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

A) 1.6%.

B) 0.8%.

C) 1.0%.

D) 1.4%.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Use the information for the question(s)below.<br>Luther Industries

Q6: Consider a zero-coupon bond with a $1000

Q7: The YTM of a 4-year default-free security

Q8: Use the table for the question(s)below.<br>Consider the

Q9: Which of the following statements is FALSE?<br>A)The

Q11: Sovereign debt is:<br>A)debt issued by national governments.<br>B)debt

Q12: Use the information for the question(s)below.<br>Luther Industries

Q13: Consider a zero-coupon bond with a $1000

Q14: Use the information for the question(s)below.<br>Luther Industries

Q15: Wyatt Oil is contemplating issuing a 20-year