Multiple Choice

Use the information for the question(s) below.

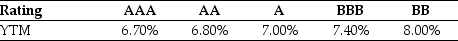

Luther Industries needs to raise $25 million to fund a new office complex.The company plans on issuing ten-year bonds with a face value of $1000 and a coupon rate of 7.0% (annual payments) .The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:

-Suppose that when these bonds were issued,Luther received a price of $972.42 for each bond.What is the likely rating that Luther's bonds received?

A) AA

B) BBB

C) B

D) A

Correct Answer:

Verified

Correct Answer:

Verified

Q7: The YTM of a 4-year default-free security

Q8: Use the table for the question(s)below.<br>Consider the

Q9: Which of the following statements is FALSE?<br>A)The

Q10: Use the table for the question(s)below.<br>Consider the

Q11: Sovereign debt is:<br>A)debt issued by national governments.<br>B)debt

Q13: Consider a zero-coupon bond with a $1000

Q14: Use the information for the question(s)below.<br>Luther Industries

Q15: Wyatt Oil is contemplating issuing a 20-year

Q16: Consider a corporate bond with a $1000

Q17: Which of the following statements is FALSE?<br>A)Bond