Multiple Choice

Use the information for the question(s) below.

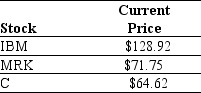

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-Suppose a security with a risk-free cash flow of $1000 one year from now trades for $909 today.If there are no arbitrage opportunities,then the current risk-free interest rate is closest to:

A) 8%.

B) 10%.

C) 11%.

D) 12%.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Use the information for the question(s)below.<br>An independent

Q57: Use the table for the question(s)below. <img

Q58: Rearden Metal needs to order a new

Q59: Which of the following statements regarding the

Q60: You have an investment opportunity in the

Q62: Suppose that Bondi Inc.is a holding company

Q63: Use the table for the question(s)below. <img

Q64: Use the table for the question(s)below. <img

Q65: Use the table for the question(s)below. <img

Q66: Use the information below to answer the