Multiple Choice

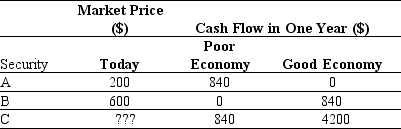

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

A) $88.

B) $92.

C) $93.

D) $95.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: Use the table for the question(s)below.<br>Consider the

Q53: Which of the following statements regarding value

Q54: Use the information for the question(s)below.<br>An exchange

Q55: Which of the following statements regarding arbitrage

Q56: Use the information for the question(s)below.<br>An independent

Q58: Rearden Metal needs to order a new

Q59: Which of the following statements regarding the

Q60: You have an investment opportunity in the

Q61: Use the information for the question(s)below.<br>An exchange

Q62: Suppose that Bondi Inc.is a holding company