Essay

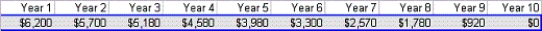

Estimate the mean and standard deviation of the NPV of this project.Assume that cash flows are discounted at a rate of 10% per year.Now assume that the project has an abandonment option.At the end of each year you can abandon the project for the values given below:  For example,suppose that year 1 cash flow is $400.Then,at the end of year 1,you expect cash flow for each remaining year to be $400.This has an NPV of less than $6200,so you should abandon the project and collect $6200 at the end of year 1.Estimate the mean and standard deviation of the project with the abandonment option.How much would you pay for the abandonment option? (Hint: You can abandon a project at most once.Thus,in year 5,for example,you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned.Also,once you abandon the project,the actual cash flows for future years will 0.So,the future cash flows after abandonment should disappear.)

For example,suppose that year 1 cash flow is $400.Then,at the end of year 1,you expect cash flow for each remaining year to be $400.This has an NPV of less than $6200,so you should abandon the project and collect $6200 at the end of year 1.Estimate the mean and standard deviation of the project with the abandonment option.How much would you pay for the abandonment option? (Hint: You can abandon a project at most once.Thus,in year 5,for example,you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned.Also,once you abandon the project,the actual cash flows for future years will 0.So,the future cash flows after abandonment should disappear.)

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which function is often required in simulations

Q3: In a marketing and sales model,what might

Q4: Consider a device that requires two batteries

Q5: In a bidding model,once we have a

Q6: Although we can determine the optimal bid

Q7: Churn is an example of the type

Q8: In investment models,we typically must simulate the

Q9: Simulate Amanda's portfolio over the next 30

Q10: A @RISK output range allows us to

Q11: Which two random variables are typically simulated