Multiple Choice

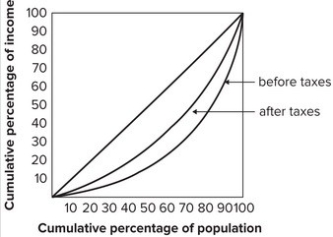

The graph shows that:

A) the effect of taxes is to make the distribution of income less equal.

B) the effect of taxes is to make the distribution of income more equal.

C) before-tax income and after-tax income are both equally distributed.

D) taxes are highly regressive.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: U.S. poverty figures do not include in-kind

Q13: An increase in the tax rate can

Q18: On the Lorenz curve, a perfectly equal

Q23: Which of the following Gini coefficients represents

Q23: When measuring income distribution according to class,

Q29: In some countries the tax system is

Q50: Which of the following statements is true?<br>A)

Q63: Which of the following statements is a

Q83: A Gini coefficient of 1 denotes:<br>A) zero

Q127: Refer to the graph shown. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7143/.jpg"