Multiple Choice

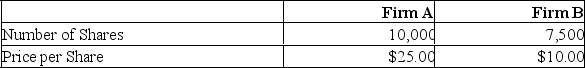

Both firms are 100% equity-financed. Firm A can acquire firm B for $82,500 in the form of either cash or stock. The synergy value of the deal is $12,500.  What will the price per share be of the post-merger firm if payment is made in stock?

What will the price per share be of the post-merger firm if payment is made in stock?

A) $25.00

B) $25.38

C) $25.50

D) $25.76

E) $27.30

Correct Answer:

Verified

Correct Answer:

Verified

Q14: If the average cost per unit decreases

Q15: Provide a definition of a leveraged buyouts

Q16: Provide a definition of corporate governance.

Q17: Suppose you have the following information concerning

Q18: Weston Bakery and Early's Bakery are all-equity

Q20: As a means of protecting their company

Q21: Provide a definition of greenmail.

Q22: Studies of acquisitions and mergers suggest that

Q23: Tax reductions represents a synergistic benefits from

Q24: An agreement between firms to create a