Multiple Choice

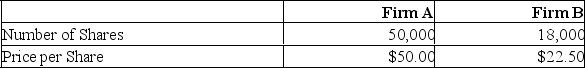

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the value of Firm B to A in this case?

What is the value of Firm B to A in this case?

A) $138,000

B) $250,000

C) $405,000

D) $655,000

E) $920,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Provide a definition of an amalgamation.

Q13: Both firms are 100% equity-financed. Firm A

Q14: If the average cost per unit decreases

Q15: Provide a definition of a leveraged buyouts

Q16: Provide a definition of corporate governance.

Q18: Weston Bakery and Early's Bakery are all-equity

Q19: Both firms are 100% equity-financed. Firm A

Q20: As a means of protecting their company

Q21: Provide a definition of greenmail.

Q22: Studies of acquisitions and mergers suggest that