Multiple Choice

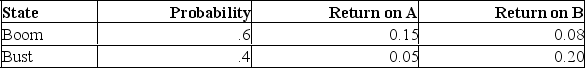

What is the expected return on a portfolio that is equally-weighted amongst A, B, and the risk-free asset? The return on the risk-free asset is 4%.

What is the expected return on a portfolio that is equally-weighted amongst A, B, and the risk-free asset? The return on the risk-free asset is 4%.

A) 8.9%

B) 9.3%

C) 10.1%

D) 11.8%

E) 13.8%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q364: You are considering purchasing stock S. This

Q365: _ measures total risk.<br>A) The mean.<br>B) Beta.<br>C)

Q366: Risk that affects at most a small

Q367: Provide a graphical representation of the volatility

Q368: Total risk - Systematic risk = Unsystematic

Q370: Which one of the following is an

Q371: Low-beta stocks are sold and replaced with

Q372: Explain some of the key differences between

Q373: Which one of the following stocks is

Q374: The weights that are commonly used when