Multiple Choice

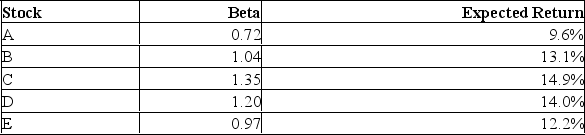

Which one of the following stocks is correctly priced if the risk-free rate of return is 3.8% and the market risk premium is 8.5%?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q368: Total risk - Systematic risk = Unsystematic

Q369: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q370: Which one of the following is an

Q371: Low-beta stocks are sold and replaced with

Q372: Explain some of the key differences between

Q374: The weights that are commonly used when

Q375: Diversification works because forming stocks into portfolios

Q376: The primary purpose of portfolio diversification is

Q377: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q378: You have a portfolio consisting of equal