Multiple Choice

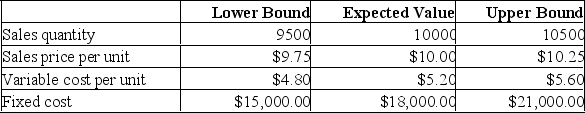

Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000

Initial requirement for equipment: $120,000

Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

What is the net income under the worst-case scenario?

A) -$11,575

B) -$7,524

C) $1,316

D) $4,051

E) $7,524

Correct Answer:

Verified

Correct Answer:

Verified

Q134: What is the contribution margin for a

Q135: As additional equipment is purchased, the level

Q136: A firm is considering a project with

Q137: Which one of the following statements concerning

Q138: If a division of a firm faces

Q140: Provide a definition for the term managerial

Q141: The Better Bilt Co. is fairly cautious

Q142: A project has the following estimated data:

Q143: Matrix, Inc. currently has sales of $39,600,

Q144: Soft rationing is the:<br>A) Situation that exists