Multiple Choice

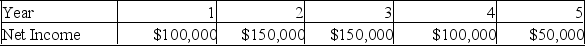

You are looking at an investment which has an initial cost of $400,000 and a salvage value of zero after five years. What is the average accounting return for this investment given the following annual net incomes:

A) 1%

B) 36%

C) 44%

D) 48%

E) 55%

Correct Answer:

Verified

Correct Answer:

Verified

Q291: It will cost $14,900 to acquire a

Q292: Project A has a five-year life and

Q293: You are considering two mutually exclusive projects

Q294: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q295: Ilona is considering two projects both of

Q297: In comparing two projects using an NPV

Q298: Without using formulas, provide a definition of

Q299: If an investment has a(n) _ of

Q300: Which capital investment evaluation technique offers the

Q301: Suppose a firm invests $600 in a