Multiple Choice

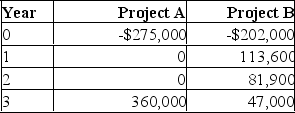

You are considering two mutually exclusive projects with the following cash flows. Which project(s) should you accept if the discount rate is 7 %? What if the discount rate is 10 %?

A) Accept project A as it always has the higher NPV.

B) Accept project B as it always has the higher NPV.

C) Accept A at 7 % and B at 10 %.

D) Accept B at 7 % and A at 10 %.

E) Accept A at 7 % and neither at 10 %.

Correct Answer:

Verified

Correct Answer:

Verified

Q288: No matter how many forms of investment

Q289: Without using formulas, provide a definition of

Q290: Your required return is 15%. Should you

Q291: It will cost $14,900 to acquire a

Q292: Project A has a five-year life and

Q294: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" What is the

Q295: Ilona is considering two projects both of

Q296: You are looking at an investment which

Q297: In comparing two projects using an NPV

Q298: Without using formulas, provide a definition of