Multiple Choice

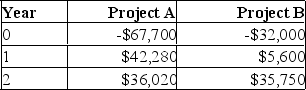

You are considering two independent projects with the following cash flows, both of which have been assigned a discount rate of 9.5 %. Based on the profitability index (PI) , what is your recommendation concerning these projects?

A) Accept Project A only.

B) Accept Project B only.

C) Accept both Project A and B.

D) Reject both Project A and B.

E) You cannot use the PI method of analysis in this situation.

Correct Answer:

Verified

Correct Answer:

Verified

Q142: Which one of the following methods of

Q143: An investment is acceptable if the profitability

Q144: You are comparing two mutually exclusive projects.

Q145: Which of the following statements is false?<br>A)

Q146: Project A and B have 4 year

Q148: The capital budgeting process addresses what products

Q149: Which capital investment evaluation technique is described

Q150: You are considering the following two mutually

Q151: The IRR is the most widely used

Q152: Larry's Lanterns is considering a project which