Multiple Choice

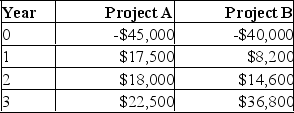

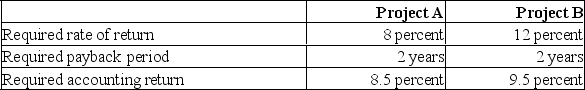

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

You should _____ Project A and _____ Project B based on the payback period of each project.

You should _____ Project A and _____ Project B based on the payback period of each project.

A) accept; accept

B) accept; reject

C) reject; accept

D) reject; reject

E) The payback method should not be used to determine which of these projects should be accepted.

Correct Answer:

Verified

Correct Answer:

Verified

Q145: Which of the following statements is false?<br>A)

Q146: Project A and B have 4 year

Q147: You are considering two independent projects with

Q148: The capital budgeting process addresses what products

Q149: Which capital investment evaluation technique is described

Q151: The IRR is the most widely used

Q152: Larry's Lanterns is considering a project which

Q153: Fulton Corporation purchased an asset costing $525,000.

Q154: Project X has a cost of $750

Q155: Which one of the following is the