Multiple Choice

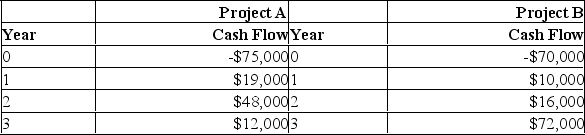

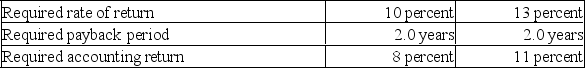

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.

Based on the net present value method of analysis and given the information in the problem, you should:

Based on the net present value method of analysis and given the information in the problem, you should:

A) Accept both project A and project B.

B) Accept project A and reject project B.

C) Accept project B and reject project A.

D) Reject both project A and project B.

E) Accept whichever one you want as they represent equal opportunities.

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Based on the profitability index (PI) rule,

Q62: What is the net present value of

Q63: If the required return is zero, then:<br>A)

Q64: If the internal rate of return on

Q65: Explain the differences and similarities between NPV

Q67: Average accounting return employs some sort of

Q68: The present value created per dollar invested

Q69: An investment has the following cash flows.

Q70: _ quantifies, in dollar terms, how stockholder

Q71: A 25- year project has a cost