Multiple Choice

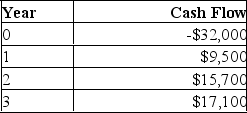

An investment has the following cash flows. Should the project be accepted if it has been assigned a required return of 14.5 %? Why or why not?

A) Yes; because the IRR is 14.8 %.

B) Yes; because the IRR is 14.3 %.

C) Yes; because the IRR is 13.9 %.

D) No; because the IRR is 13.9 %.

E) No; because the IRR is 14.3 %.

Correct Answer:

Verified

Correct Answer:

Verified

Q64: If the internal rate of return on

Q65: Explain the differences and similarities between NPV

Q66: You are considering the following two mutually

Q67: Average accounting return employs some sort of

Q68: The present value created per dollar invested

Q70: _ quantifies, in dollar terms, how stockholder

Q71: A 25- year project has a cost

Q72: You are considering two mutually exclusive projects

Q73: You are comparing two mutually exclusive projects.

Q74: The net present value of a project