Multiple Choice

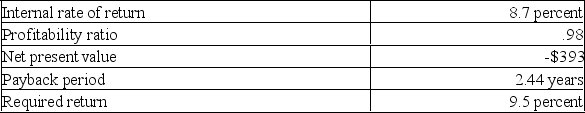

You are considering a project with the following data:  Which one of the following is correct given this information?

Which one of the following is correct given this information?

A) The discount rate used in computing the net present value must have been less than 8.7 %.

B) The discounted payback period will have to be less than 2.44 years.

C) The discount rate used to compute the profitability ratio was equal to the internal rate of return.

D) This project should be accepted based on the profitability ratio.

E) This project should be rejected based on the internal rate of return.

Correct Answer:

Verified

Correct Answer:

Verified

Q160: The use of the internal rate of

Q161: Your firm's CFO presents you with two

Q162: From a finance perspective, discounted payback is

Q163: Project A has a five-year life and

Q164: The difference between the present value of

Q166: The internal rate of return (IRR) is

Q167: What is the net present value of

Q168: The purchase of new equipment is classified

Q169: Which one of the following is a

Q170: Bridgewater Fountains is considering expanding its current