Multiple Choice

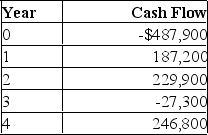

Bridgewater Fountains is considering expanding its current line of business and has developed the following expected cash flows for the project. Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 9.6 %? Why or why not?

A) Yes; The IRR is 9.11 %.

B) Yes; The IRR is 11.87 %.

C) Yes; The IRR is 11.99 %.

D) No; The IRR is 11.87 %.

E) No; The IRR is 11.99 %.

Correct Answer:

Verified

Correct Answer:

Verified

Q165: You are considering a project with the

Q166: The internal rate of return (IRR) is

Q167: What is the net present value of

Q168: The purchase of new equipment is classified

Q169: Which one of the following is a

Q171: Yuli is analyzing the following two mutually

Q172: You run a small bagel shop and

Q173: The internal rate of return method of

Q174: If a project with conventional cash flows

Q175: The crossover point occurs where the IRR