Multiple Choice

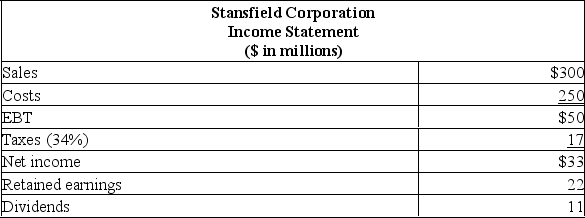

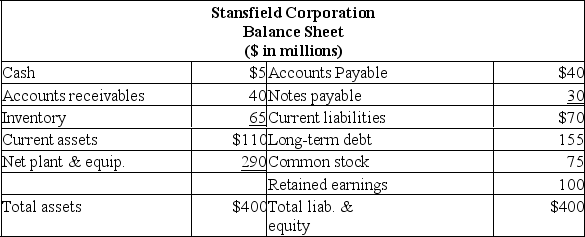

Assume Stansfield Corporation is utilizing its fixed assets at 90% capacity. Assume costs, current liabilities, and current assets vary directly with sales, and that the dividend payout ratio remains unchanged. If sales increase by 20%, what will total fixed assets be?

Assume Stansfield Corporation is utilizing its fixed assets at 90% capacity. Assume costs, current liabilities, and current assets vary directly with sales, and that the dividend payout ratio remains unchanged. If sales increase by 20%, what will total fixed assets be?

A) $256 million

B) $286 million

C) $313 million

D) $359 million

E) $470 million

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Why is it important for managers to

Q247: Calculate depreciation expense given the following information.

Q248: Consider that you are a finance manager,

Q250: Suppose a firm calculates its EFN and

Q251: By compiling pro forma statements, firms can:<br>A)

Q253: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Assets,

Q254: What four elements are incorporated in financial

Q255: All else the same, sustainable growth will

Q256: A firm has an ROE of 7.5%

Q257: Which of the following is a factor