Multiple Choice

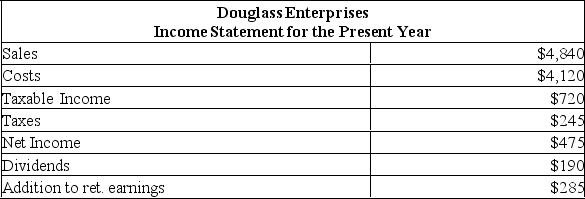

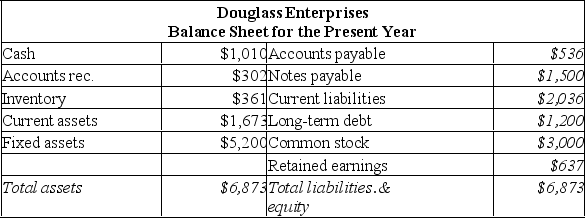

Assets, accounts payable and costs are proportional to sales. Debt and equity are not.

Assets, accounts payable and costs are proportional to sales. Debt and equity are not.

The sales of Douglass Enterprises are expected to increase by 14% next year. The firm is currently producing at full capacity. Management wants to maintain a constant debt-equity ratio and a constant dividend payout ratio. What is the external financing need?

A) -$325

B) -$238

C) $542

D) $562

E) $962

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Why is it important for managers to

Q248: Consider that you are a finance manager,

Q250: Suppose a firm calculates its EFN and

Q251: By compiling pro forma statements, firms can:<br>A)

Q252: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Assume

Q254: What four elements are incorporated in financial

Q255: All else the same, sustainable growth will

Q256: A firm has an ROE of 7.5%

Q257: Which of the following is a factor

Q258: You wish to compute a firm's sustainable