Multiple Choice

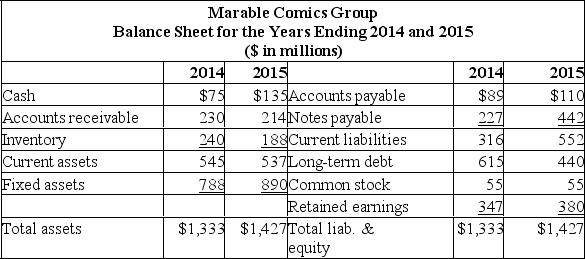

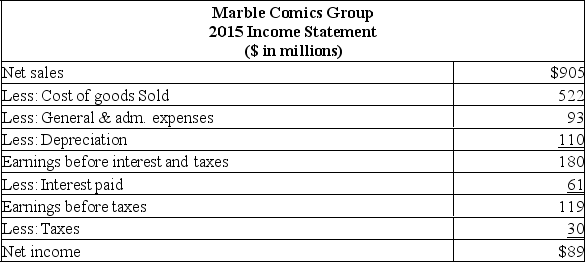

Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the firm's tax rate remains unchanged, the dividend payout is 40%, and Marble is operating at 70% of capacity, what is the external financing needed (EFN) for 2018 ($ in millions) ?

Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the firm's tax rate remains unchanged, the dividend payout is 40%, and Marble is operating at 70% of capacity, what is the external financing needed (EFN) for 2018 ($ in millions) ?

A) EFN is negative

B) $21.94

C) $48.31

D) $76.32

E) $89.85

Correct Answer:

Verified

Correct Answer:

Verified

Q299: All else the same, an increase in

Q300: Calculate the projected fixed assets needed given

Q301: Financial planning:<br>A) Encourages managers to separate their

Q302: The retention ratio is equal to one

Q303: Assuming that a company has a policy

Q305: A firm desires a sustainable growth rate

Q306: The following balance sheet and income statement

Q307: Pro forma statements are a common element

Q308: A Toronto firm has current sales of

Q309: Calculate the sustainable growth rate given the