Multiple Choice

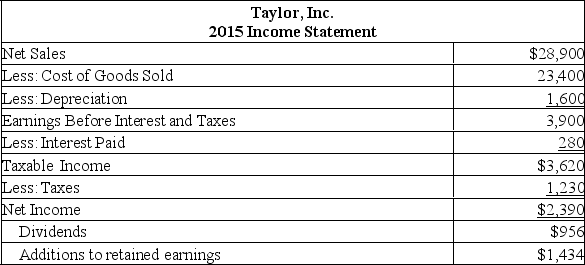

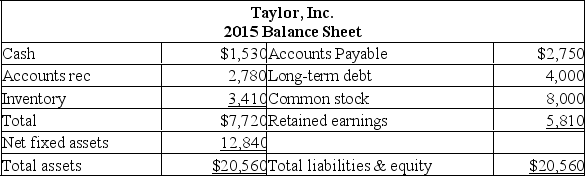

The following balance sheet and income statement should be used:

Assume that all costs, assets, and current liabilities of Taylor, Inc. increase directly with sales. Also assume that the tax rate, the dividend payout ratio and profit margin ratio are constant. The firm is currently operating at full capacity. What is the external financing need if sales increase by 8 percent?

Assume that all costs, assets, and current liabilities of Taylor, Inc. increase directly with sales. Also assume that the tax rate, the dividend payout ratio and profit margin ratio are constant. The firm is currently operating at full capacity. What is the external financing need if sales increase by 8 percent?

A) -$123.92

B) -$12.87

C) -$9.20

D) $11.68

E) $108.14

Correct Answer:

Verified

Correct Answer:

Verified

Q301: Financial planning:<br>A) Encourages managers to separate their

Q302: The retention ratio is equal to one

Q303: Assuming that a company has a policy

Q304: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Assume

Q305: A firm desires a sustainable growth rate

Q307: Pro forma statements are a common element

Q308: A Toronto firm has current sales of

Q309: Calculate the sustainable growth rate given the

Q310: Calculate total current assets given the following

Q311: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7297/.jpg" alt=" Assume costs and