Multiple Choice

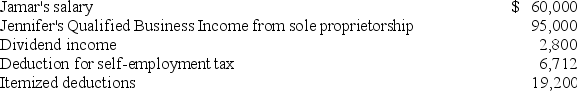

Jennifer and Jamar are married and live in a home with their 13-year-old dependent son,Oscar.This year,they had the following tax information.  Compute adjusted gross income (AGI) and taxable income.

Compute adjusted gross income (AGI) and taxable income.

A) AGI $157,800; taxable income $124,188.

B) AGI $157,800; taxable income $130,900.

C) AGI $151,088; taxable income $89,888.

D) AGI $151,088; taxable income $107,888.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: For the taxable year in which a

Q40: Mr. Jackson has $100,000 of qualified business

Q58: An individual must pay the greater of

Q60: Mr.and Mrs.Daniels,ages 45,and 42,had the following income

Q63: An itemized deduction doesn't result in any

Q64: Ms.Kilo's regular income tax before credits on

Q65: Mr.and Mrs.Reid reported $1,435,700 ordinary taxable income

Q66: Mr.Jones and his first wife were legally

Q67: Mr.and Mrs.Stern reported $1,148,340 alternative minimum taxable

Q89: Which of the following statements concerning extensions