Multiple Choice

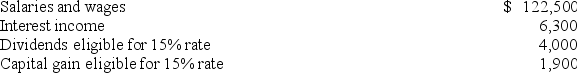

Mr.and Mrs.Daniels,ages 45,and 42,had the following income items in 2019:  Mr.and Mrs.Daniels have no dependents and claim the standard deduction.Compute their income tax liability on a joint return.

Mr.and Mrs.Daniels have no dependents and claim the standard deduction.Compute their income tax liability on a joint return.

A) $15,570

B) $16,868

C) $22,348

D) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: For the taxable year in which a

Q40: Mr. Jackson has $100,000 of qualified business

Q54: Mr. and Mrs. Eller's AGI last year

Q56: Mr.and Mrs.Kain reported $80,000 AGI on their

Q58: An individual must pay the greater of

Q62: Jennifer and Jamar are married and live

Q63: An itemized deduction doesn't result in any

Q64: Ms.Kilo's regular income tax before credits on

Q65: Mr.and Mrs.Reid reported $1,435,700 ordinary taxable income

Q89: Which of the following statements concerning extensions