Multiple Choice

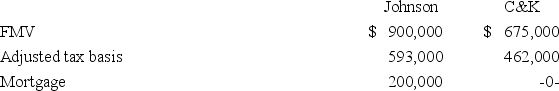

Johnson Inc.and C&K Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

Pursuant to the exchange,C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property.Compute Johnson's gain recognized on the exchange and its tax basis in the property received from C&K.

A) $25,000 gain recognized; $593,000 basis in C&K property.

B) $25,000 gain recognized; $793,000 basis in C&K property.

C) $225,000 gain recognized; $593,000 basis in C&K property.

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Acme Inc. and Beamer Company exchanged like-kind

Q20: Muro Inc. exchanged an old inventory item

Q21: Perry Inc.and Dally Company entered into an

Q24: Mrs.Brinkley transferred business property (FMV $340,200; adjusted

Q26: Mr.and Mrs.Meredith own a sole proprietorship consisting

Q30: In June,a fire completely destroyed office furniture

Q81: Tauber Inc. and J&I Company exchanged like-kind

Q93: Tarletto Inc.'s current year income statement includes

Q99: A fire destroyed equipment used by BLP

Q101: Denali, Inc. exchanged realty with a $230,000