Multiple Choice

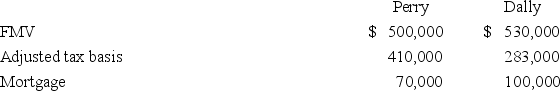

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.  Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

A) $30,000 gain recognized; $313,000 basis in the Perry property.

B) 100,000 gain recognized; $383,000 basis in the Perry property.

C) $30,000 gain recognized; $283,000 basis in the Perry property.

D) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Itak Company transferred an old asset with

Q18: Mr.and Mrs.Eyre own residential rental property that

Q19: Perry Inc.and Dally Company entered into an

Q20: Muro Inc. exchanged an old inventory item

Q24: Mrs.Brinkley transferred business property (FMV $340,200; adjusted

Q25: Johnson Inc.and C&K Company entered into an

Q26: Mr.and Mrs.Meredith own a sole proprietorship consisting

Q81: Tauber Inc. and J&I Company exchanged like-kind

Q85: Oxono Company realized a $74,900 gain on

Q93: Tarletto Inc.'s current year income statement includes