Multiple Choice

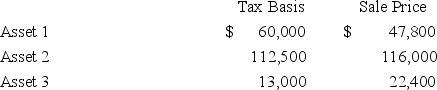

Gupta Company made the following sales of capital assets this year.  What is the effect of the three sales on Gupta's taxable income?

What is the effect of the three sales on Gupta's taxable income?

A) $700 increase

B) $12,900 increase

C) No effect

D) None of the choices are correct

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Tullia Inc. recognized $500,000 ordinary income, $22,600

Q16: Six years ago,Alejo Company purchased real property

Q17: O&V sold a business asset with a

Q19: A corporation can use the installment sale

Q20: R&T Inc.made the following sales of capital

Q23: Fantino Inc.was incorporated in 2018 and adopted

Q26: The installment sale method of accounting is

Q63: Abada Inc. has a $925,000 basis in

Q65: Which of the following is a capital

Q113: Inventory, accounts receivable, and machinery used in