Multiple Choice

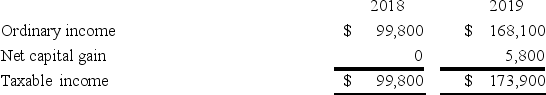

Fantino Inc.was incorporated in 2018 and adopted a calendar year for tax purposes.Here is a schedule of Fantino's taxable income for 2018 and (tax rate is 21% for 2019) .  In 2020,Fantino generated $297,300 ordinary income and recognized a $14,000 net capital loss.Which of the following statements is true?

In 2020,Fantino generated $297,300 ordinary income and recognized a $14,000 net capital loss.Which of the following statements is true?

A) Fantino can deduct its $14,000 net capital loss only on a carryforward basis.

B) Fantino can carry the net capital loss back to 2018 and receive a $2,940 refund of 2018 tax.

C) Fantino can deduct the capital loss against its 2020 ordinary income,producing $2,940 of tax savings.

D) Fantino can carry the net capital loss back to 2019 and receive a $1,218 refund of 2019 tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Tullia Inc. recognized $500,000 ordinary income, $22,600

Q19: A corporation can use the installment sale

Q20: R&T Inc.made the following sales of capital

Q21: Gupta Company made the following sales of

Q26: The installment sale method of accounting is

Q28: Nilex Company sold three operating assets this

Q63: Abada Inc. has a $925,000 basis in

Q65: Which of the following is a capital

Q102: Blitza Inc. owned real property used for

Q113: Inventory, accounts receivable, and machinery used in