Multiple Choice

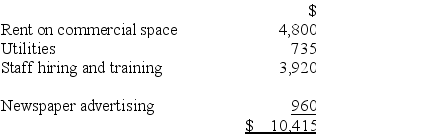

Vane Company,a calendar year taxpayer,incurred the following expenditures in the preoperating phase of a new health and fitness center.  Which of the following statements is true?

Which of the following statements is true?

A) If Vane already operates seven other health and fitness centers,it can deduct the $10,415 preoperating expenditures of the eighth center as expansion costs.

B) If Vane is a cash basis taxpayer,it can deduct $10,415 in the year of payment.

C) If the new center represents a new business for Vane,it must capitalize the $10,415 preoperating expenditures.

D) None of the above is true

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following statements about the

Q18: Elcox Inc. spent $2.3 million on a

Q20: Stanley Inc., a calendar year taxpayer, purchased

Q62: On November 7, a calendar year business

Q71: Pyle Inc.,a calendar year taxpayer,generated over $10

Q74: Hoopin Oil Inc.was allowed to deduct $5.3

Q75: Mr.and Mrs.Schulte paid a $750,000 lump-sum price

Q76: Ingol,Inc.was organized on June 1 and began

Q76: Four years ago, Bettis Inc. paid a

Q78: Kemp Inc.,a calendar year taxpayer,generated over $10