Multiple Choice

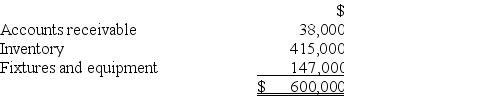

Mr.and Mrs.Schulte paid a $750,000 lump-sum price to purchase a business.At date of purchase,the appraised FMVs of the balance sheet assets were:  Which of the following statements is true?

Which of the following statements is true?

A) The Schultes must allocated the $750,000 cost to the balance sheet assets based on the assets' relative FMV.

B) The Schultes must capitalize $150,000 of the cost to nonamortizable goodwill.

C) The Schultes may deduct $150,000 of the cost as business goodwill.

D) None of the above is true.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Elcox Inc. spent $2.3 million on a

Q62: On November 7, a calendar year business

Q71: Pyle Inc.,a calendar year taxpayer,generated over $10

Q73: Vane Company,a calendar year taxpayer,incurred the following

Q74: Hoopin Oil Inc.was allowed to deduct $5.3

Q76: Ingol,Inc.was organized on June 1 and began

Q76: Four years ago, Bettis Inc. paid a

Q78: Kemp Inc.,a calendar year taxpayer,generated over $10

Q105: Deitle Inc. manufactures small appliances. This year,

Q111: Purchased goodwill is amortizable both for book