Multiple Choice

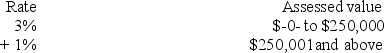

Vervet County levies a real property tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

A) If Mr.Clem owns real property valued at $112,500,his average tax rate is 3%.

B) If Ms.Barker owns real property valued at $455,650,her average tax rate is 2.1%.

C) If Ms.Lumley owns real property valued at $750,000,her marginal tax rate is 1%.

D) None of the choices are false.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Assume that Congress plans to amend the

Q11: Which of the following statements about tax

Q26: Jurisdiction M imposes an individual income tax

Q29: Assume that Congress plans to amend the

Q29: Jurisdiction M imposes an individual income tax

Q30: The country of Valhalla levies an income

Q45: According to the Keynesian concept of efficiency,

Q47: According to supply-side economic theory, a decrease

Q62: Which of the following statements concerning a

Q81: Congress originally enacted the federal estate and