Essay

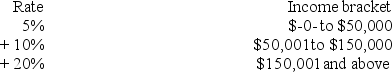

The country of Valhalla levies an income tax with the following rate structure.

A.Mrs.Greene's annual income is $125,000.Compute her tax,her average tax rate,and her marginal tax rate.

A.Mrs.Greene's annual income is $125,000.Compute her tax,her average tax rate,and her marginal tax rate.

B.Mr.Chen's annual income is $220,000.Compute his tax,his average tax rate,and his marginal tax rate.

C.Does Valhalla have a proportionate,progressive,or regressive tax rate structure?

Correct Answer:

Verified

A.Mrs.Greene's tax is $10,000 = (5% × $5...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Assume that Congress plans to amend the

Q10: The federal government is not required to

Q26: Jurisdiction M imposes an individual income tax

Q27: Vervet County levies a real property tax

Q29: Jurisdiction M imposes an individual income tax

Q34: Which of the following statements does not

Q47: According to supply-side economic theory, a decrease

Q62: Which of the following statements concerning a

Q75: Which of the following statements concerning tax

Q81: Congress originally enacted the federal estate and