Multiple Choice

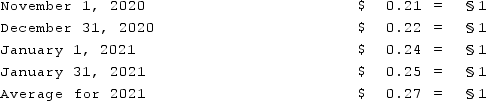

A subsidiary of Dunder Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) which is the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2020, for §160,000 that was sold on January 17, 2021 for §207,000. The subsidiary paid for the inventory on January 31, 2021. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for cost of goods sold on Dunder's consolidated income statement at December 31, 2021?

What amount would have been reported for cost of goods sold on Dunder's consolidated income statement at December 31, 2021?

A) $33,600.

B) $35,200.

C) $38,400.

D) $40,000.

E) $43,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q73: Under what circumstances would the remeasurement of

Q74: Perez Company, a Mexican subsidiary of a

Q75: Dilty Corp. owned a subsidiary in France.

Q76: Under the current rate method, depreciation expense

Q77: Certain balance sheet accounts of a foreign

Q79: When preparing a consolidated statement of cash

Q80: Quadros Inc., a Portuguese firm was acquired

Q81: On January 1, 2021, Veldon Co., a

Q82: Quadros Inc., a Portuguese firm was acquired

Q83: Where is the translation adjustment reported in