Essay

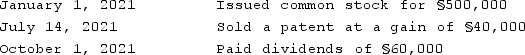

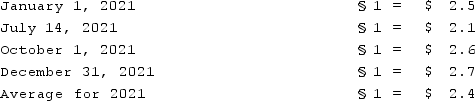

On January 1, 2021, Veldon Co., a U.S. corporation with the U.S. dollar as its functional currency, established Malont Co. as a subsidiary. Malont is located in the country of Sorania, and its functional currency is the stickle (§). Malont engaged in the following transactions during 2021:  Malont's operating revenues and expenses for 2021 were §800,000 and §650,000, respectively. The appropriate exchange rates were:

Malont's operating revenues and expenses for 2021 were §800,000 and §650,000, respectively. The appropriate exchange rates were:  Required:Calculate the translation adjustment for Malont. (Round your answers to the nearest whole dollar.)

Required:Calculate the translation adjustment for Malont. (Round your answers to the nearest whole dollar.)

Correct Answer:

Verified

Correct Answer:

Verified

Q76: Under the current rate method, depreciation expense

Q77: Certain balance sheet accounts of a foreign

Q78: A subsidiary of Dunder Inc., a U.S.

Q79: When preparing a consolidated statement of cash

Q80: Quadros Inc., a Portuguese firm was acquired

Q82: Quadros Inc., a Portuguese firm was acquired

Q83: Where is the translation adjustment reported in

Q84: Under the temporal method, which accounts are

Q85: Quadros Inc., a Portuguese firm was acquired

Q86: Kennedy Company acquired all of the outstanding